All Categories

Featured

Table of Contents

- – Who has the best customer service for Guarante...

- – How do I cancel Indexed Universal Life Tax Be...

- – Who offers Guaranteed Interest Indexed Univer...

- – What is included in Indexed Universal Life T...

- – How do I cancel Indexed Universal Life Calcu...

- – Who provides the best Iul Interest Crediting?

In the event of a lapse, impressive plan finances in excess of unrecovered cost basis will certainly be subject to normal earnings tax obligation. If a plan is a modified endowment agreement (MEC), plan car loans and withdrawals will certainly be taxed as common revenue to the level there are incomes in the plan.

Tax obligation laws undergo change and you should consult a tax specialist. It is essential to keep in mind that with an external index, your policy does not straight join any type of equity or fixed earnings financial investments you are denying shares in an index. The indexes offered within the plan are created to keep an eye on varied sections of the U.S

These indexes are benchmarks just. Indexes can have different components and weighting approaches. Some indexes have numerous versions that can weight parts or might track the effect of rewards in different ways. An index may affect your rate of interest attributed, you can not get, straight get involved in or get returns settlements from any of them via the plan Although an outside market index might impact your interest credited, your plan does not directly participate in any type of supply or equity or bond financial investments.

This material does not use in the state of New york city. Guarantees are backed by the monetary strength and claims-paying capacity of Allianz Life Insurance Coverage Firm of North America. Products are provided by Allianz Life insurance policy Business of North America, 5701 Golden Hills Drive, Minneapolis, MN 55416-1297. .

Protect your loved ones and save for retired life at the same time with Indexed Universal Life Insurance. (IUL interest crediting)

Who has the best customer service for Guaranteed Indexed Universal Life?

HNW index global life insurance policy can assist build up cash money value on a tax-deferred basis, which can be accessed throughout retired life to supplement revenue. (17%): Policyholders can commonly borrow versus the cash money value of their plan. This can be a resource of funds for different requirements, such as buying an organization or covering unanticipated costs.

The survivor benefit can aid cover the costs of searching for and training a substitute. (12%): In some instances, the cash money value and survivor benefit of these policies might be safeguarded from lenders. This can provide an extra layer of monetary protection. Life insurance policy can additionally help reduce the risk of an investment portfolio.

How do I cancel Indexed Universal Life Tax Benefits?

(11%): These plans use the potential to gain passion connected to the efficiency of a stock exchange index, while likewise providing an ensured minimum return (Indexed Universal Life loan options). This can be an appealing option for those looking for growth potential with disadvantage defense. Resources forever Research Study 30th September 2024 IUL Study 271 participants over one month Indexed Universal Life Insurance Coverage (IUL) may appear intricate initially, but recognizing its mechanics is vital to comprehending its complete capacity for your financial planning

As an example, if the index gains 11% and your engagement rate is 100%, your money value would certainly be credited with 11% rate of interest. It is essential to note that the maximum passion attributed in a given year is covered. Allow's state your chosen index for your IUL policy gained 6% from the start of June to the end of June.

The resulting rate of interest is contributed to the cash worth. Some plans determine the index gains as the sum of the changes through, while other policies take an average of the everyday gains for a month. No passion is credited to the money account if the index goes down as opposed to up.

Who offers Guaranteed Interest Indexed Universal Life?

The rate is set by the insurance provider and can be anywhere from 25% to more than 100%. (The insurer can additionally change the engagement price over the life time of the policy.) If the gain is 6%, the participation price is 50%, and the present money value overall is $10,000, $300 is included to the money worth (6% x 50% x $10,000 = $300). IUL policies generally have a flooring, commonly evaluated 0%, which shields your cash value from losses if the marketplace index performs negatively.

The passion credited to your cash value is based on the performance of the chosen market index. The portion of the index's return credited to your money value is figured out by the participation price, which can differ and be changed by the insurance policy company.

Store around and contrast quotes from different insurer to discover the best policy for your demands. Carefully review the policy pictures and all terms prior to choosing. IUL involves some degree of market threat. Prior to picking this kind of policy, ensure you fit with the prospective changes in your cash money worth.

What is included in Indexed Universal Life Tax Benefits coverage?

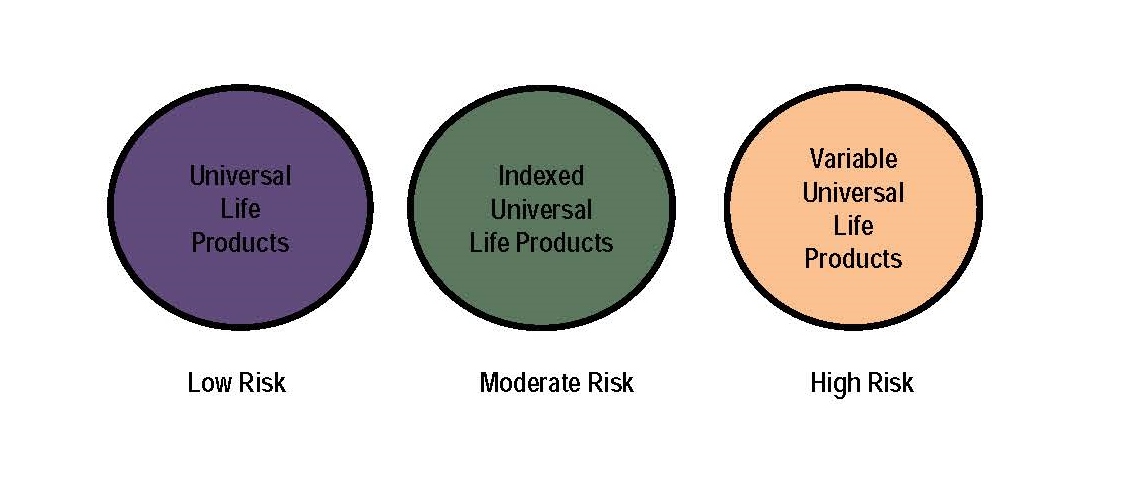

By comparison, IUL's market-linked cash value development uses the potential for greater returns, especially in beneficial market conditions. Nevertheless, this capacity features the danger that the stock exchange efficiency may not supply continually steady returns. IUL's flexible costs settlements and flexible survivor benefit supply adaptability, interesting those seeking a plan that can develop with their changing financial conditions.

Indexed Universal Life Insurance Coverage (IUL) and Term Life Insurance policy are various life policies. Term Life Insurance coverage covers a particular duration, generally in between 5 and 50 years.

It appropriates for those looking for short-lived protection to cover details financial responsibilities like a home mortgage or children's education charges or for service cover like investor protection. Indexed Universal Life (IUL), on the other hand, is a long-term life insurance coverage plan that provides insurance coverage for your entire life. It is a lot more pricey than a Term Life policy due to the fact that it is made to last all your life and offer a guaranteed cash payment on death.

How do I cancel Indexed Universal Life Calculator?

Picking the ideal Indexed Universal Life (IUL) policy has to do with locating one that straightens with your monetary objectives and risk resistance. A well-informed monetary advisor can be vital in this procedure, assisting you with the intricacies and guaranteeing your chosen plan is the ideal fit for you. As you research buying an IUL plan, maintain these vital considerations in mind: Comprehend exactly how credited rate of interest rates are linked to market index efficiency.

As detailed previously, IUL policies have different costs. Understand these prices. This identifies how much of the index's gains contribute to your cash money worth growth. A greater rate can enhance potential, however when comparing policies, review the money value column, which will assist you see whether a higher cap price is much better.

Who provides the best Iul Interest Crediting?

Different insurance firms offer variants of IUL. The indices connected to your plan will directly affect its efficiency. Versatility is essential, and your plan ought to adjust.

Table of Contents

- – Who has the best customer service for Guarante...

- – How do I cancel Indexed Universal Life Tax Be...

- – Who offers Guaranteed Interest Indexed Univer...

- – What is included in Indexed Universal Life T...

- – How do I cancel Indexed Universal Life Calcu...

- – Who provides the best Iul Interest Crediting?

Latest Posts

Cost Of Universal Life Insurance

New York Life Universal Life

What Is Better Term Or Universal Life Insurance

More

Latest Posts

Cost Of Universal Life Insurance

New York Life Universal Life

What Is Better Term Or Universal Life Insurance